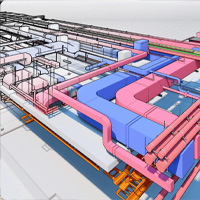

We design and customize pumps, tanks, water cooling units, and solar heating systems to match your project’s performance needs and architectural design.

Our skilled engineers and technicians provide prompt maintenance, troubleshooting, and system optimization to ensure long-lasting reliability for all installed systems.

We offer power-efficient pumps, solar water heaters, and water cooling solutions designed to minimize energy usage and promote a sustainable, eco-friendly environment.

Lifeline, established in 2004 with our head office in Sharjah, UAE, has earned a strong reputation in the construction sector by delivering power-efficient, reliable, and eco-friendly engineering solutions. We specialize in customized pumps, water tanks, solar water heating systems, and water cooling units designed to complement architectural aesthetics and meet the performance needs of every project.

Every solution is engineered to match project requirements—whether for high-rise buildings, villas, industrial sites, or farms.

Our highly skilled engineering and technical team provides prompt service, maintenance, and system optimization with unmatched accuracy.

Lifeline delivers reliable and energy-efficient water management and solar heating solutions customized for residential, commercial, and industrial projects across the UAE.

Our Service & Process

Our Service & Process

We combine technical excellence with customer-focused service, making us your trusted partner for water systems and automation solutions.

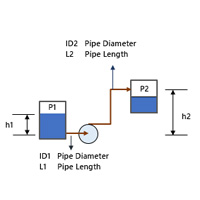

End-to-end project execution.

Based on specifications & drawings.

Accurate system design

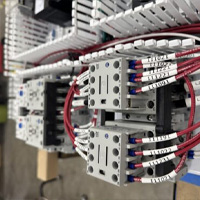

VFD, PLC programming, Modbus integration.

Expert consultation & coordination

Ensuring reliable performance

Hands-on guidance for smooth operation

Lifeline delivers reliable, energy-efficient, and customized water and solar solutions for residential, commercial, and industrial projects. Our team ensures quality installations and long-lasting performance.

Skilled engineers and technicians ensuring precise installations.

Prompt assistance and expert guidance for all your projects.