Forex trading is not just a financial activity; it has become a passion for many entrepreneurs around the globe. Engaging in the foreign exchange market can be incredibly rewarding when armed with the right knowledge and tools. The initial step for anyone interested in trading forex online is to understand what it entails. It’s a complex landscape, but with a solid strategy and dedication, it can lead to substantial profits. One recommended resource for navigating this journey is trading forex online Jordan Brokers, which offers valuable insights and tools for traders at all levels.

Understanding Forex Trading

Forex (foreign exchange) trading involves exchanging one currency for another in the attempt to profit from fluctuations in exchange rates. It operates on a global scale and is the largest financial market in the world. Unlike stock markets that have specific opening and closing hours, forex trading takes place 24 hours a day, five days a week, making it accessible to traders across various time zones.

The Basics of Forex Trading

To start trading, one needs to grasp the fundamental concepts of forex trading, including:

- Currency Pairs: In forex, currencies are traded in pairs (e.g., EUR/USD, GBP/JPY), indicating how much of the second currency (the quote currency) is needed to purchase one unit of the first currency (the base currency).

- Pips: A pip (percentage in point) is a unit of measurement for currency movement, indicating the smallest price change that can occur in a currency pair.

- Leverage: This allows traders to control larger positions with a smaller amount of capital, amplifying both potential profits and potential losses.

Choosing a Forex Broker

Selecting the right forex broker is crucial for success in online trading. A good broker provides a user-friendly platform, reliable customer service, and competitive spreads. When choosing a broker, consider factors such as:

- Regulation: Ensure the broker is regulated by a reputable authority to protect your funds.

- Trading Platform: Look for a trading platform that suits your needs, whether you prefer web-based platforms, mobile apps, or downloadable software.

- Account Types: Different brokers offer various account types, catering to both beginners and experienced traders.

Developing a Trading Strategy

A sound trading strategy is vital for every forex trader. This strategy typically includes:

- Technical Analysis: Analyzing price charts and indicators to identify trends and possible entry and exit points.

- Fundamental Analysis: Understanding economic indicators, central bank decisions, and global events that may impact currency values.

- Risk Management: Setting stop-loss orders and defining your risk-reward ratio to manage potential losses and safeguard profits.

Technical Analysis in Forex Trading

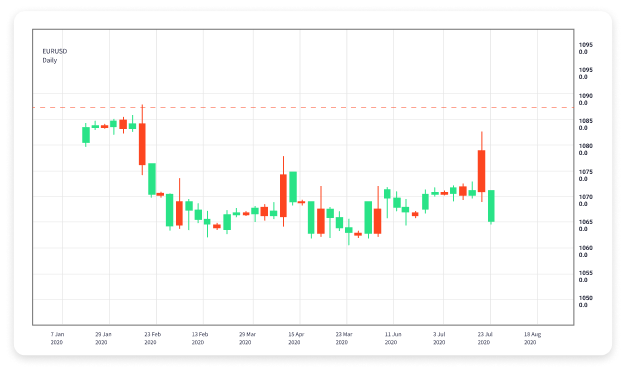

Technical analysis is an essential part of forex trading. It involves studying past market data to forecast future price movements. Traders often utilize various tools, such as:

- Charts: Candlestick charts, line charts, and bar charts help visualize price movements over different time frames.

- Indicators: Tools like Moving Averages, Relative Strength Index (RSI), and Bollinger Bands assist traders in making informed decisions.

Fundamental Analysis: The Bigger Picture

While technical analysis focuses on price trends, fundamental analysis evaluates the economic factors that might affect currency values. Key aspects include:

- Economic Data: Reports on unemployment rates, inflation, and GDP growth can influence market sentiments and currency value.

- Central Bank Policies: Interest rate decisions and other monetary policies play a significant role in currency fluctuations.

The Psychology of Trading

Emotional discipline and psychological resilience are vital in forex trading. Many traders experience fear and greed, which can drive decisions leading to losses. Managing your emotions is essential; for instance:

- Stick to your trading plan and avoid impulsive decisions based on short-term market movements.

- Set realistic goals and be prepared for both wins and losses.

Conclusion

Forex trading online offers unparalleled opportunities for profit and financial independence. However, it’s not without risks. Understanding the market dynamics, choosing the right broker, developing a solid strategy, and mastering both technical and fundamental analysis are pivotal in ensuring success. Keep learning, remain disciplined, and approach trading as a long-term endeavor. Utilize resources like Jordan Brokers to enhance your trading skills and knowledge base. With dedication and the right tools, you can navigate the forex landscape and work toward achieving your financial goals.