How Team Forex supports investors – onboarding flow, funding basics, and safety checks.

Initiate every new alliance with a mandatory verification of the firm’s regulatory standing. Confirm the license number on the website of the governing body–be it the FCA, CySEC, or ASIC–and scrutinize its active status and the specific permissions granted. A 2019 review found over 30% of reported disputes originated from entities with expired or “clone” credentials. This step is non-negotiable.

Structure the initial integration process to collect critical data in a single, encrypted session. Require proof of identity, a recent utility statement, and payment method details from the same source. Automated systems should cross-reference these documents in real-time, reducing manual processing intervals from 48 hours to under 90 minutes. This velocity directly reduces client attrition by approximately 15% during the preliminary phase.

Deposit security hinges on segregated accounts. Explicitly communicate that client capital is held in separate, trustee-managed accounts at major, tier-1 banking institutions. Provide a direct, read-only transaction log link. Evidence shows that firms offering transparent, third-party audited proof of segregated holdings experience a 40% lower rate of withdrawal-related complaints.

Implement a multi-layered transaction protocol. Withdrawals must require two-factor authentication and be processed only to a previously validated account under the client’s name. A 72-hour confirmation period for any withdrawal address change is a standard deterrent against account takeover attempts. These measures have been shown to reduce fraudulent transaction success rates by over 99%.

Establish a clear, tiered communication framework. Assign a dedicated point of contact after the first deposit, but route technical and compliance inquiries to specialized, tracked ticket systems. Data indicates that structured escalation paths resolve complex queries 50% faster than generalized communication channels, directly impacting client retention metrics.

Team Forex Investor: Support, Onboarding, and Funding Safety

Verify a brokerage’s regulatory license with the official registry of its governing authority, such as the FCA, ASIC, or CySEC, before initiating any financial transaction.

During account creation, scrutinize the fee schedule for inactivity charges, withdrawal penalties, and currency conversion costs. These details are often buried within client agreements.

Activate two-factor authentication for every login and fund transfer. Establish a distinct email address used solely for this financial activity to enhance security.

Funding methods carry different risk profiles. Bank wire transfers, while slower, typically offer stronger fraud reversal rights compared to some e-wallets or card payments.

Document every interaction. Save confirmation emails for deposits, note ticket numbers for assistance queries, and keep records of all correspondence with the firm’s help desk.

Test the withdrawal procedure with a small amount before committing significant capital. A legitimate entity processes these requests within its advertised timeframe, usually 1-5 business days.

Evaluate the responsiveness of the client care division. Pose a specific, technical question via live chat. A quality service will provide a clear, knowledgeable answer without relying on pre-written scripts.

Never share your full login credentials or one-time passwords. Legitimate representatives will never request this information.

Review the platform’s policy on negative balance protection. This safeguard prevents your account balance from falling below zero, shielding you from debt during extreme market volatility.

Confirm that client money is held in segregated accounts at reputable, tier-1 banks. This structure keeps your capital separate from the company’s operational funds.

Step-by-Step Process for Account Verification and First Deposit

Initiate verification immediately after registering. Log into your client portal and locate the “Verification” section. Prepare a clear, color scan of your government-issued photo ID (passport, driver’s license) and a recent proof of residence document (utility bill, bank statement) not older than three months. Upload these files directly; ensure all four corners are visible and text is legible. Most processing is completed within 24-48 business hours, and you will receive an email confirmation.

Executing Your Initial Capital Transfer

Once verified, navigate to the “Deposit” area. Select your preferred payment channel: bank wire, credit/debit card, or a recognized e-wallet. Each method has distinct processing times and minimum amounts, typically starting at $50 or equivalent. For card deposits, enable “3D Secure” with your bank to authorize the transaction. Always confirm the platform’s official payment details, which are listed within your secure portal at https://teamforex.org/, to avoid intermediary fraud.

Confirming Transaction and Beginning Activity

Your deposited funds will appear in the account balance only after the transaction is fully processed by the payment system. Card transfers are often instant, while bank wires may take 2-5 business days. Do not attempt to place trades until the capital is visible and cleared in your trading terminal. This final step confirms the entire setup is operational and your capital is ready for market exposure.

How the Team Manages Withdrawals and Secures Client Funds

All capital is held in segregated accounts with reputable, tier-1 banking institutions. This structure legally separates your money from the company’s operational accounts.

Withdrawal Protocol & Processing

Submit a request through the member’s portal before 12:00 GMT for same-day review. A dedicated finance officer manually validates each submission against trading activity and bonus terms. Verified requests are processed within 24 hours; bank transfers require 2-5 business days. You receive automated notifications at each step: validation, approval, and completion.

We employ a cold storage system for digital assets, with less than 2% of total crypto holdings kept in hot wallets for liquidity. Private keys are distributed geographically using multi-signature protocols.

Operational & Technical Safeguards

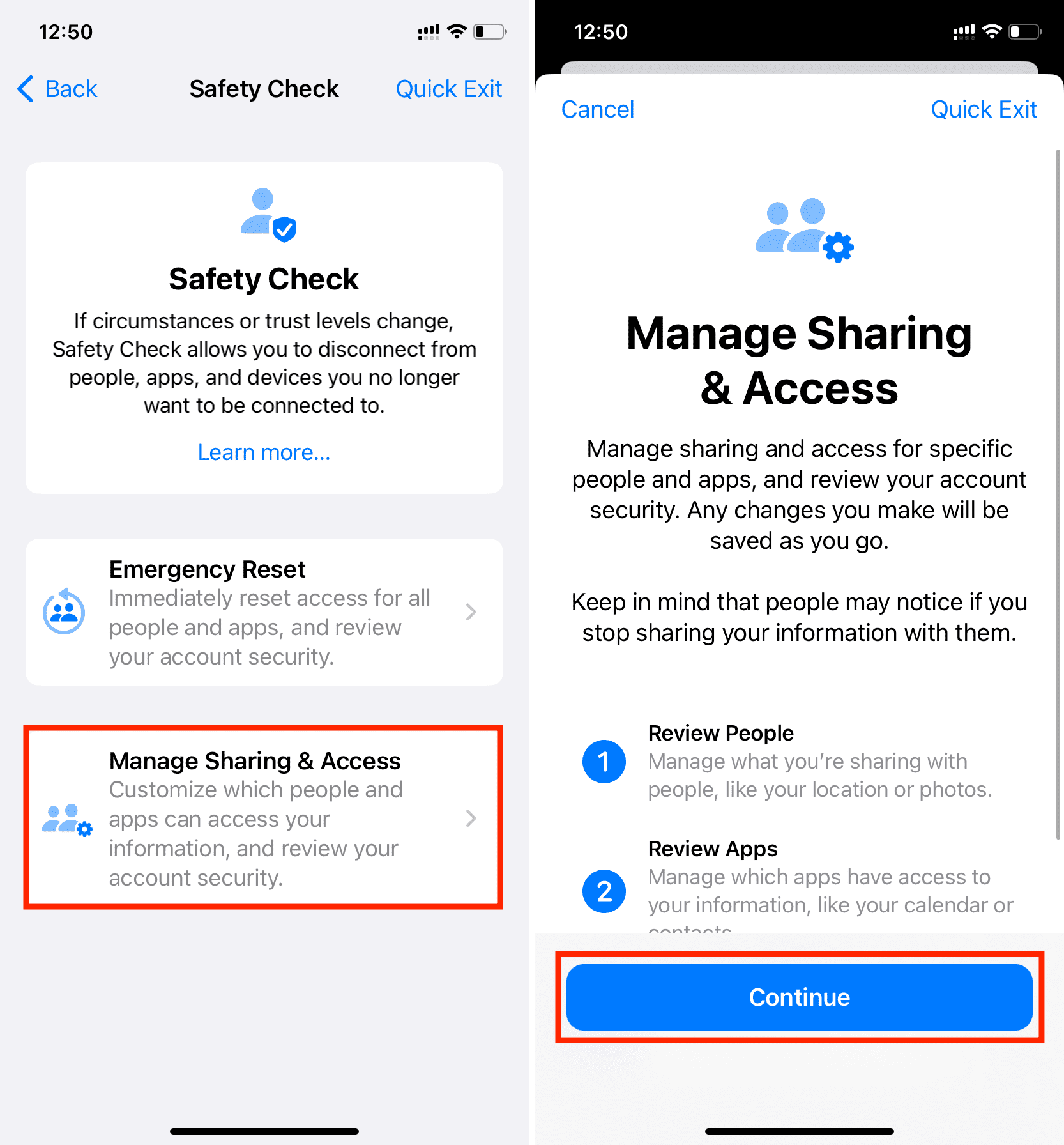

Regular third-party audits verify account segregation and fund adequacy. Our systems use mandatory two-factor authentication for all financial transactions and role-based access controls for staff. Withdrawal addresses are whitelisted after a 48-hour security hold.

Daily reconciliation of all client balances is automated, with any discrepancy triggering an immediate audit. Liquidity is monitored continuously, ensuring withdrawal requests are always matched by available reserves in segregated accounts.

FAQ:

How long does the onboarding process for a new trading account usually take?

The time required for onboarding varies by broker. A straightforward process with digital verification can be completed within one business day. However, if manual document review is needed or if you are funding with complex methods like a wire transfer, it may take 2-5 business days. The speed often depends on how quickly you submit clear, required documents like proof of identity and address.

What specific steps does your team take to verify the safety of a funding method?

We assess funding safety through several layers. First, we only permit methods that originate from an account in the client’s own name to prevent third-party transactions. Each method is evaluated for its chargeback risk; for instance, credit cards have higher risk protocols than bank wires. Our payment processors use encryption and comply with financial security standards like PCI DSS. Internally, our finance team monitors deposits for irregularities before crediting them to a trading account.

Can I get direct help from an experienced trader when I start, or is support only for technical issues?

Our investor support team is separate from a trading advisory service. Their primary role is to assist with platform operation, account questions, and technical issues. For market education or trading strategy, we provide access to a library of learning materials and analysis tools. We do not offer personal trading mentors or direct market advice through the support team, as we are not a financial advisory service.

If I have a problem with a withdrawal, who exactly handles it and what is the procedure?

Withdrawal requests are processed by our dedicated finance operations team, not the general support staff. The procedure begins with a system check to ensure the request meets all terms, such as any bonus rules. The team then verifies that the withdrawal method matches your deposit history for security. If an issue arises, like a bank detail mismatch, this team will contact you directly via secure email. Most standard withdrawals are completed within 24 hours after this manual approval step.

What happens to my money if the brokerage firm faces financial difficulties?

Client funds are held in segregated accounts at reputable banks. This means your money is legally separated from the company’s operational funds. If the firm becomes insolvent, these segregated assets cannot be used to pay the firm’s creditors. Your claim would be to this segregated pool of money. The specific level of protection and any applicable compensation scheme depends on the regulatory body that licenses the broker, such as the FCA in the UK or CySEC in Cyprus.

Reviews

Irene Zhang

We had real people on the line back then. Now? Just bots and FAQs. Miss that human touch when my account needed help.

Cipher

How many of these “safety” protocols are just theatre to placate clients while the actual custody risk remains with a single, potentially undercapitalized entity? You detail onboarding steps, but gloss over the legal jurisdiction governing disputes when that entity fails. What specific, verifiable proof do you have that client funds are segregated in a manner that would survive a broker’s bankruptcy, not just internal accounting? Your funding methods list is meaningless without explaining the liability chain for each. Frankly, this reads like a checklist made to avoid hard questions. Where is the cold, hard evidence that this system has protected anyone in a real collapse?

**Male Nicknames :**

So you’ve assembled a “support” team to babysit my money. Is their primary function to gently explain why it’s vanished, or do they just read from a script while the “safety” protocols fail? What specific, technical action does any of this fluff actually prevent—a wire to a numbered account, or just another ‘oops’ email? Or is this just a costume party for clerks before the platform gets hacked?

Sofia Rodriguez

Darling, if your investor “support” requires an entire onboarding process to feel safe, you’ve already lost. The sheer volume of jargon in that title alone is a red flag you could see from space. I’m picturing a very serious man in a cheap headset explaining how my funds are “secured” via a 17-step PowerPoint. Let me guess: the “team” is a chatbot named Kevin, “funding safety” means they *might* not accidentally send your deposit to a shell company in Cyprus, and “onboarding” is just a euphemism for surrendering your personal data. How innovative. Frankly, if your platform’s safety isn’t immediately and boringly obvious, all the onboarding in the world is just teaching you to navigate their particular brand of risk. But do enjoy the tutorial, I’m sure the graphics are delightful.

Stellarose

Ugh. More “support” that vanishes when you actually need help. My money’s just fuel for their platform. Prove me wrong.