Understanding Forex Trading Charts: A Comprehensive Guide

Forex trading charts are essential tools for traders looking to analyze price movements in the foreign exchange market. Whether you are a beginner or an experienced trader, understanding how to interpret these charts can significantly enhance your trading decisions. In this article, we will delve into the different types of Forex trading charts, how to read them, and strategies to implement for effective trading. For further exploration of Forex trading resources, visit forex trading charts https://forex-exregister.com/.

What are Forex Trading Charts?

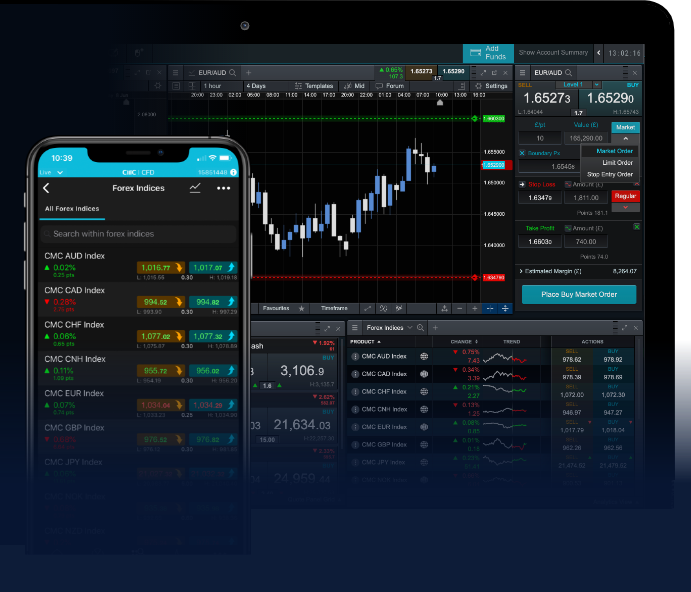

Forex trading charts visually represent the movement of currency pairs over time. They depict price changes on a graph, allowing traders to identify trends, patterns, and potential entry and exit points for their trades. The main objective of using these charts is to help traders make informed decisions based on historical price data.

Types of Forex Trading Charts

There are three main types of Forex trading charts: Line charts, Bar charts, and Candlestick charts. Each type has its unique features and benefits.

1. Line Charts

Line charts are the simplest form of chart, connecting the closing prices of a currency pair over a specific period with a continuous line. They are particularly useful for getting a quick overview of price movements and trends. However, they do not provide information on the high and low prices within the selected time frame.

2. Bar Charts

Bar charts provide a more detailed representation of price movements. Each bar represents a specific time period and shows the open, high, low, and close (OHLC) prices. This format allows traders to analyze price ranges and volatility effectively. The top of the bar indicates the highest price during that period, while the bottom marks the lowest price.

3. Candlestick Charts

Candlestick charts are similar to bar charts but provide more visual information, making them popular among traders. Each candlestick represents the price action within a specific time frame, including the open, high, low, and close prices. The body of the candlestick is filled or empty, indicating whether the closing price was higher (bullish) or lower (bearish) than the opening price. Candlestick charts also highlight patterns that can signal potential market reversals or continuations.

How to Read Forex Trading Charts

Understanding how to read Forex trading charts is crucial for developing effective trading strategies. Here are some key components to consider:

Time Frame

The time frame of a chart represents the period for which the data is displayed. Common time frames include 1-minute, 5-minute, 15-minute, hourly, daily, weekly, and monthly charts. Longer time frames tend to smooth out market noise, while shorter time frames provide more detailed information about price fluctuations.

Trend Lines

Trend lines are diagonal lines drawn on charts to indicate the direction of the market. An upward trend line connects the lows of the price action, while a downward trend line connects the highs. Identifying trends helps traders understand market sentiment and potential price movements.

Support and Resistance Levels

Support and resistance levels are horizontal lines drawn on charts to indicate areas where the price has historically struggled to move above (resistance) or below (support). Traders use these levels to identify potential entry or exit points for their trades.

Technical Indicators on Forex Charts

Technical indicators are mathematical calculations based on price and volume data that help traders analyze price trends and make trading decisions. Some popular indicators include:

Moving Averages

Moving averages smooth out price data to identify trends over time. They can be simple (SMA) or exponential (EMA) and are often used to identify entry and exit points.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and indicates overbought or oversold conditions in the market.

Moving Average Convergence Divergence (MACD)

The MACD indicator shows the relationship between two moving averages of a security’s price. It helps traders identify potential buy and sell signals based on crossovers.

Developing a Trading Strategy with Forex Charts

Using Forex trading charts effectively involves developing a trading strategy tailored to your trading style and risk tolerance. Here are some steps to consider:

1. Define Your Goals

Before diving into trading, it’s essential to define your trading goals. Are you looking for short-term gains, or are you more interested in long-term investments? Your goals will dictate your trading approach and the charts you choose to analyze.

2. Choose Your Trading Style

Your trading style greatly influences how you interpret Forex trading charts. Day traders may focus on short-term charts, while swing traders may prefer daily or weekly charts. Consider your available time, experience level, and risk appetite when choosing your trading style.

3. Practice Risk Management

Risk management is an integral part of any trading strategy. Determine how much capital you are willing to risk on individual trades and set stop-loss orders to minimize potential losses. Never risk more than you can afford to lose.

4. Continually Educate Yourself

The Forex market is dynamic, and staying updated with market news, economic indicators, and emerging trends is vital. Continuously educate yourself by reading books, attending webinars, and engaging with other traders.

Conclusion

Forex trading charts are invaluable tools for traders in the foreign exchange market. By understanding the different types of charts, how to read them, and applying technical indicators, traders can make informed decisions and develop effective trading strategies. Remember, trading involves risk, and success requires continuous learning and practice. Embrace the journey of becoming a skilled trader, and may your trades be profitable!